In today’s insurance landscape, trust isn’t just a nice-to-have—it’s the cornerstone of sustainable business. At Argos Labs, we’ve discovered that the trust layer of insurance claims is highly sought after, and we’re pioneering solutions that address this critical need through our integrated automation platform powered by Lazarus AI and LCPy.

The Challenge: Beyond Traditional Claims Processing

Working extensively with large insurance companies across the UK, we’ve identified a fundamental truth: fraud detection is only as effective as our prevention efforts. The insurance industry processes millions of claims annually, each requiring meticulous verification, assessment, and processing—tasks that traditionally consume enormous human resources while leaving room for both error and exploitation.

Our Solution: Counter Fraud Intelligence Through Automation

Advanced Image Analysis & Document Processing

Our integrated platform leverages sophisticated Counter Fraud image analysis capabilities, transforming how insurers approach claim verification. From photographs of accident scenes to detailed invoices across repair networks, our digital workers powered by OCR and ICR technologies create an intelligent verification ecosystem.

Key Capabilities include:

Automated photograph authentication and analysis

- Invoice verification and cross-referencing

- Supply chain documentation validation

- Real-time anomaly detection across all touchpoints

- Straight-Through Processing (STP): From simple to complex claims

Working alongside field Subject Matter Experts (SMEs), we’ve developed STP workflows that handle everything from straightforward claims to the most complex cases. Our platform learns, adapts, and improves with each interaction.

Building Trust Through FNOL and ENOL Excellence

First and Electronic Notification of Loss

Our FNOL and ENOL capabilities serve as the critical first touchpoints in the trust-building journey. By providing direct reporting to policyholders and fleet hire personnel, we ensure transparency and immediate communication that sets the tone for the entire claims experience.

Due Diligence That Protects

The platform performs comprehensive due diligence on potential customers, adding an extra layer of protection and ensuring trust is established from the outset.

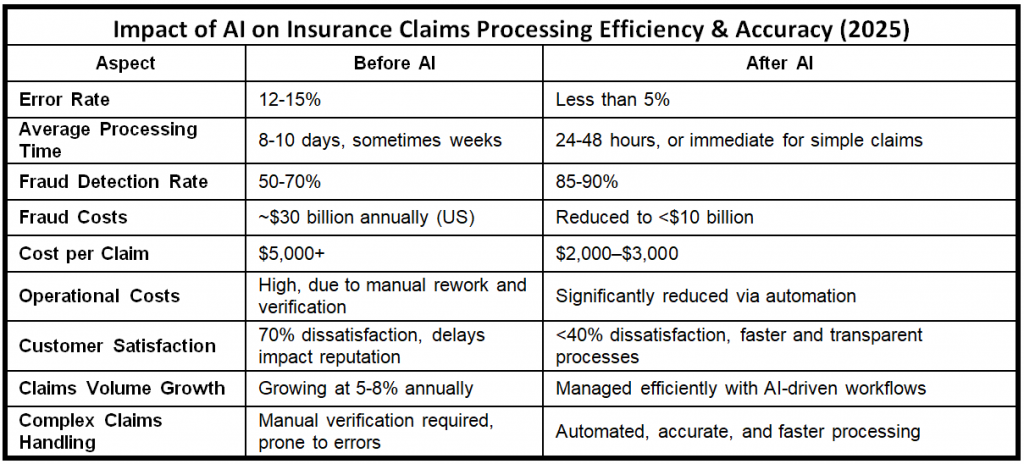

Source: Based on industry reports and market trends from Accenture, McKinsey, IBM, and Triple-I.

Revolutionizing Customer Interaction

Mobile-First Approach

Our innovative customer interaction methodology leverages cutting-edge mobile technology, recognizing that today’s policyholders expect seamless, instant access to their claims information and updates.

Boosting Customer Satisfaction Across All Segments

We’ve achieved remarkable improvements in Customer Satisfaction Scores (TNPS) across:

Personal Lines: Streamlined processing for individual policyholders

- Commercial Lines: Efficient handling of business claims

- High Net Worth (HNW): Specialized service for premium clientele

Specialized Coverage for Luxury Assets

Our platform excels in managing complex, high-value claims involving:

- Luxury Yachts: Maritime-specific documentation and verification

- Aircraft: Aviation compliance and specialized requirements

- Exotic Automobiles: High-value vehicle authentication and repair network management

- Valuables Collections: Art, jewellery, and other precious items requiring specialized handling

The Argos Labs Advantage: Leading Innovation in Insurance Technology

Why We’re Different

- Integrated Ecosystem: Creating an intelligent, connected workflow that automates end-to-end processes

- Industry Expertise: Deep partnerships with UK insurance leaders and field SMEs

- Scalable Solutions: From boutique insurers to large enterprises

- Trust-First Approach: Designing every feature to enhance transparency and reliability

Real Results

Our clients report:

- Up to 70% reduction in processing times

- Improved fraud detection rates

- Increased customer satisfaction scores

- Streamlined compliance and reporting

Looking Forward: The Future of Insurance Automation

The insurance industry is at an inflection point. Companies that embrace intelligent automation today will shape tomorrow’s customer expectations. At Argos Labs, we’re not just providing tools—we’re shaping the future of insurance claims processing.

Ready to transform your claims process?

Contact us to discover how Lazarus AI and LCPy can revolutionize your insurance operations, build customer trust, and drive operational excellence throughout your organization.